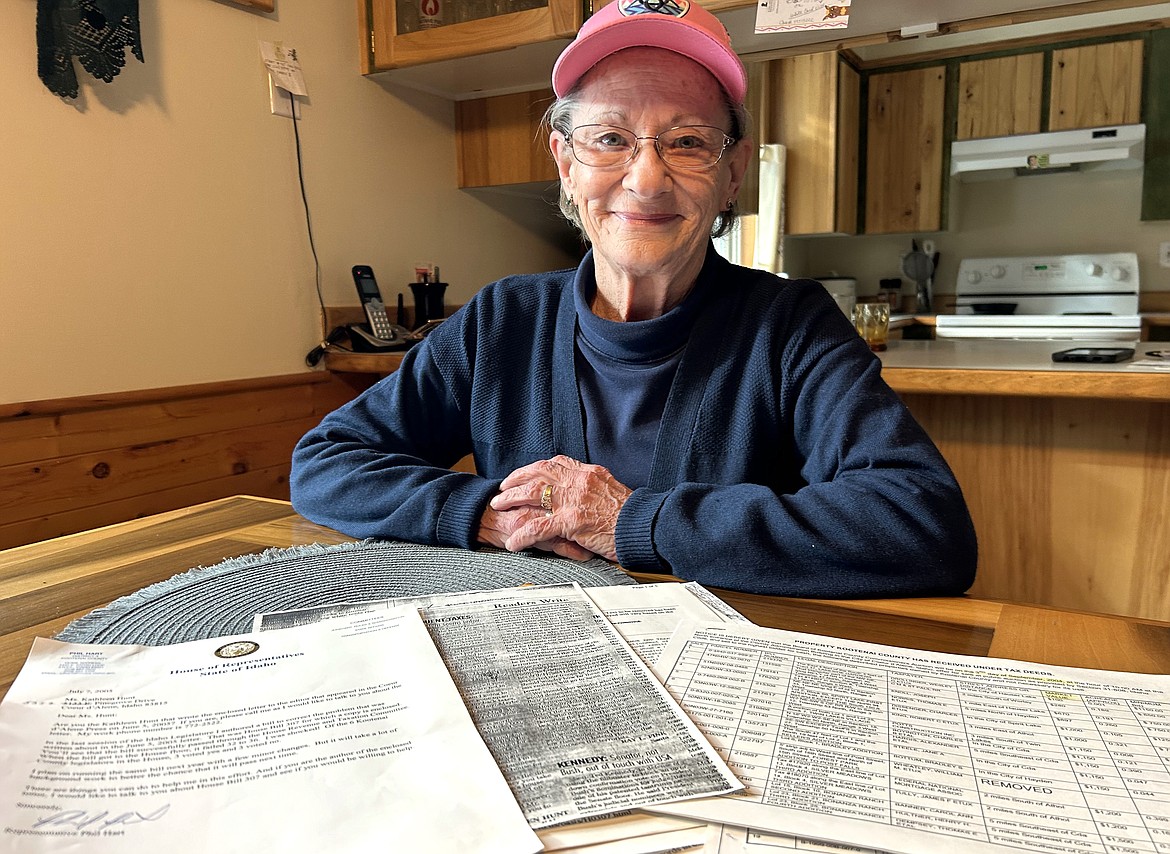

'I don't like injustice'

COEUR d’ALENE — Kathy Hunt doesn’t usually get too excited about what she hears on the news, but Thursday morning, she did.

“Holy moly, I’m making some phone calls,” the Coeur d’Alene woman said after learning that House Bill 444 had passed both the Idaho Senate and House and was bound for Gov. Brad Little’s desk. “When I heard it today, it just blew my mind.”

That afternoon, Hunt called legislators, the governor, and others seeking support of HB 444.

“We need to pressure him to sign that bill," she said.

The bill would amend Idaho Code Section 31-808 to exclude property acquired by tax deed from being gifted to other government entities without compensation to the property owner, according to the Mountain States Policy Center.

“Home equity theft is an egregious practice where the government is allowed to foreclose on a property through tax liens, sell the property, and keep all of the equity after the debts are paid,” wrote Madilynne Clark, with MSPC.

She wrote that the practice is illegal for private lien holders to pursue. Private lien holders are required to foreclose on a property, pay the debts and return surplus property to the property owner.

“The shocking behavior of governments taking property without compensation has been used in 10 other states and the District of Columbia and nine other states (including Idaho) have access to a more limited scheme,” Clark wrote.

Hunt began fighting this battle nearly 20 years ago.

She said it became a concern after her daughter’s husband died. Hunt feared her daughter could lose their home over unpaid property taxes and not receive proper compensation.

“When I realized what was going on with property taxes and them taking your house, I got involved,” Hunt said. “To me, that is total theft. I don’t like injustice."

She began researching Kootenai County properties lost to unpaid property taxes, what the value was, the minimum bid and what it went for.

She also wrote letters about the issue and contacted elected leaders.

“I wrote exactly then what is still going on today,” Hunt said.

In a June 5, 2005, letter in The Press, Hunt wrote: “Let’s say you are behind in your taxes three years, can’t pay all because your taxes doubled in one year, and you are on Social Security income. House is paid for. Worked all your life to own it free and clear, now maybe you can afford that medicine.”

She goes on to write, “House prices have gone up, so much, I can sell, pay my back taxes, but where am I going to buy?”

She used the example of a house worth $250,000, $8,000 owed in property taxes. That would leave a $242,000 profit and Hunt questioned where that money went.

“What’s the difference between the money you take in when you sell someone’s house for taxes and the money owed on taxes?” Hunt wrote.

In a July 7, 2005, letter, Rep. Phil Hart wrote to Hunt and said he authored House Bill 307 to correct the problem she addressed in her letter.

The bill passed through the House Revenue and Taxation Committee, but failed on the House floor, 36-32.

“I was shocked,” Hart wrote.

Hunt said since then, she’s paid attention to the issue, waiting and hoping for legislation to change things.

“Nothing done in the last 19 years,” she said.

Rep. Jeff Ehlers, R-Meridian, said it got his attention. He sponsored HB 444.

"It really just feels like an overreach on government power,” he said in a KTVB report

Clark wrote that in 2023, Pacific Legal Foundation brought Tyler v. Hennepin County before the United States Supreme Court. The case involved an elderly woman and stemmed from the county taking $25,000 in surplus property after her $15,000 debt was paid.

“The unanimous ruling issued from the Supreme Court in May was in favor of Tyler with Chief Justice Roberts saying, “The taxpayer must render unto Caesar what is Caesar’s, but no more,’” Clark wrote.

For Idaho, HB 444 will close the loophole that exists within the Idaho statute, she wrote. “The current language in the law allows governments to foreclose on a property and gift it to another government entity without compensation to the property owner. Selling the property and keeping the financial gain is already illegal.”

Hunt said the thought of hard-working retired people like her losing their home over unpaid property taxes is upsetting.

She said she is “thrilled with HB 444, as long as Little signs it.”

“It’s a long time coming,” Hunt said.