MY TURN: Comparing taxes in the Western States

The Tax Foundation has released its latest comparison of taxes across the country. Its new report is called “Facts & Figures 2024: How Does Your State Compare?” Realizing that states often compete against each other for people, capital and entrepreneurs, here is how Western states rank nationally on certain taxes.

For just state tax collections, Arizona ($3,292) collects the least amount of taxes per capita in the West, while California ($7,200) has the highest overall take in the country.

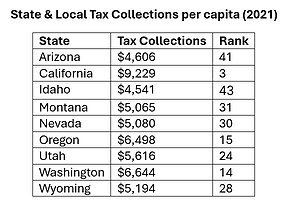

When including local tax collections, Idaho ($4,541) takes the top spot in the West with the lowest taxes paid per capita, while California ($9,229) is still the highest regionally.

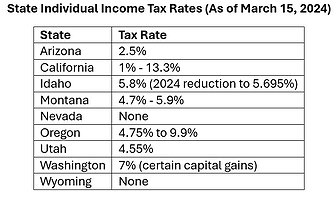

Income-tax-free Nevada and Wyoming lead the West with no income tax burden (Washington has a 7% tax on capital gains income above $250,000). Arizona has the lowest flat income tax rate regionally at 2.5%, while the Golden State (California) continues to take the most personal gold with a top rate of 13.3%.

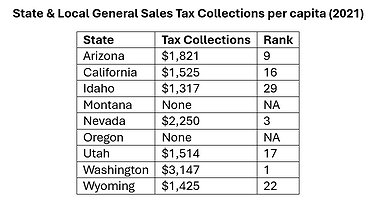

When it comes to state and local sales tax collections per capita, shoppers in Montana and Oregon face no sales tax burden. For those states with sales taxes, Idaho ($1,317) pays the least in the West, while consumers in Washington ($3,147) face the highest tax burden nationally.

With continued tax reduction efforts occurring across the country this year, these numbers are likely to change in next year’s report.

• • •

Jason Mercier is vice president and director of Research for Mountain States Policy Center, an independent research organization based in Idaho, Montana, Eastern Washington and Wyoming. Online at mountainstatespolicy.org.