After the levy fails: Political opposition, other factors contribute to defeat

COEUR d'ALENE — Multiple factors helped tank the Coeur d’Alene School District’s levy Tuesday at the polls, including an opposition campaign by the local Republican party.

The school plant facilities levy, if passed by voters, would have provided the school district with an additional $8 million per year over 10 years to support safety and maintenance needs in school buildings.

It required a 55% supermajority to pass, but received just 50.27% of the votes in favor, which was slightly more than the nearly 50% who voted against the measure.

"The failure of the levy does not change the fact that the district has some security measures and deferred maintenance issues that need to be addressed," Coeur d'Alene School Board Vice Chair Casey Morrisroe told The Press on Wednesday. "We will need to look at other options."

If approved, the levy would have provided funding to address more than $25 million in deferred maintenance projects, ranging from aging heating and cooling systems, roofs, water heaters and flooring to sound systems, alarm systems, door locks and security cameras.

"It’s unfortunate that the levy did not pass as the safety, security and maintenance needs of our buildings and district remain the same," Board Chair Rebecca Smith said.

Coeur d’Alene Superintendent Shon Hocker said district officials will take time this fall to evaluate the outcome and the district’s most-pressing safety and maintenance needs.

“I do expect the board of trustees will take up this discussion at one of its next meetings or workshops,” Hocker said. “It will be up to the trustees to decide if and when another plant facility levy request is appropriate.”

He said the district is grateful for the support it received.

“It just wasn’t enough to meet the higher passage requirement of 55% for this type of levy,” Hocker said.

He said the district is aware of efforts to oppose the levy.

“What is disappointing to see is the misinformation that appears intended to confuse or scare voters,” Hocker said. “We saw social media posts that portrayed the levy request as something far different than what it was. Voters deserve clear, honest answers, and that is what we will always provide. Unfortunately, some voters rely on social media sources that either present partial truths or blatant misinformation. We will continue to work hard to counter this misleading information moving forward.”

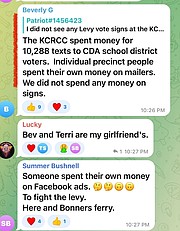

According to social media posts by Republicans affiliated with the Kootenai County Republican Central Committee, the KCRCC paid for 10,288 text messages to be sent to voters in the school district. Some voters reported receiving a text message Tuesday around 7 a.m., an hour before polls opened, from the same number used by the KCRCC to send a text to voters on May 17, the date of the Republican primary.

Tuesday’s text message did not specifically state it was from the KCRCC; however, it did include inaccurate information: “Average household to pay $235 more/yr.” That calculation is based on an incorrect levy rate and does not reflect the current rate.

The proposed levy would have added about $.31 per $1,000 of taxable assessed value, based on the 2022-23 property valuation completed this past summer. A home assessed at $595,000, with the $125,000 exemption subtracted, would have a taxable value of $470,000. At $.31 per $1,000, the levy would cost this homeowner $147.70 more per year, not $235.

Two trustees on the school board, Allie Anderton and Lesli Bjerke, are active with the KCRCC, and they both voted in favor of floating the levy before voters. The Press emailed each of them Wednesday to ask how they felt about the opposition from their party, but neither responded by press time.

A TikTok post created following the levy’s failure shows Erin Barnard, a self-described conservative and blogger who runs the Kootenai County Spectator site, slowly taking a sip of red wine while a man, presumably her husband, dances behind her. The post says: “That feeling when the $80 million levy fails.”

Morrisroe said he could only speculate why some in the community did not support the levy.

"I hope we can engage them to learn more about their reasons," he said. "Based on questions directed to me and comments I saw online, I believe the primary concerns were with the property tax impact confusion, the state of the economy and the size and scope of the request. While I am unaware of any organized campaign to encourage people to vote 'no,' there appeared to be some individuals willing to say anything to cause confusion and skepticism."

Pastor Paul Van Noy at Candlelight Christian Fellowship, speaking Aug. 17 during a regular Wednesday evening service/Q&A at the Coeur d’Alene church, urged those listening to vote against the levy.

"Since we are talking about politics, I'm going to prepare to offend some of you," he said, from a podium. "I want you to vote 'no' on the school levy."

He told them to keep in mind two of Candlelight's members are school board members.

"This is a difficult situation, because there are certain things that our school district does need — air conditioning and some improvements in structure and so forth,” Van Noy said. “But this is an inappropriate bill.”

He said the levy will “cost everyone that lives in Kootenai County.” However, the levy would have impacted only residents of the Coeur d’Alene School District, which includes Hayden.

“And it is to help support — again, I'm not sorry for what I'm about to say — but with apologies, I'll at least say this: The public school system is not your friend,” Van Noy continued. “And they are on a mission to destroy your children and it's not something that we can be supportive of, so I don't think that we should be allowing for our money, that really belongs to the Lord, to be supporting our government-run schools."

Another likely factor in the levy’s failure at the polls was hesitation by some senior citizens in the community who expressed concerns about paying more taxes for the schools.

Senior citizens in some states other than Idaho don't pay property taxes or they pay reduced rates. For Idaho to follow suit, it would take action by lawmakers in Boise.

"As Idaho continues to grow as a retirement community, I certainly would support and encourage the Legislature to explore this issue," Morrisroe said.

Hocker said he would be in favor of exempting seniors from paying taxes that fund schools.

“In fact, I'd be in favor of creating a system of property tax relief that would lessen all property taxes a senior may have to pay,” he said.

North Dakota, where he recently moved from, he said, uses the Homestead Property Tax Credit and Renter’s Refund — property tax credits available to eligible seniors older than 65 or individuals with permanent or total disabilities. He said the goal of these types of tax credits is to provide relief from increased property taxes.

“I do believe that something like this would help Idaho schools pass these types of very important levies,” Hocker said. “Although many senior citizens in our community are actively engaged in and fully support our schools, many of these same seniors are on fixed incomes that are not always keeping up with today’s inflation rates.”

Hocker said it’s important to reiterate that the school district relies on taxpayers to provide for the funding gap created by the state of Idaho’s insufficient school-funding system.

“As your superintendent, I'm committed to never asking the board to present to our taxpayers a levy or a bond unless it is vital,” Hocker said. “We have approached the point in time where our facility needs are significant and we must find a way to ensure a safe and supportive learning environment for our students and all of the staff who are there to support them.”

• • •

Maureen Dolan contributed to this report.