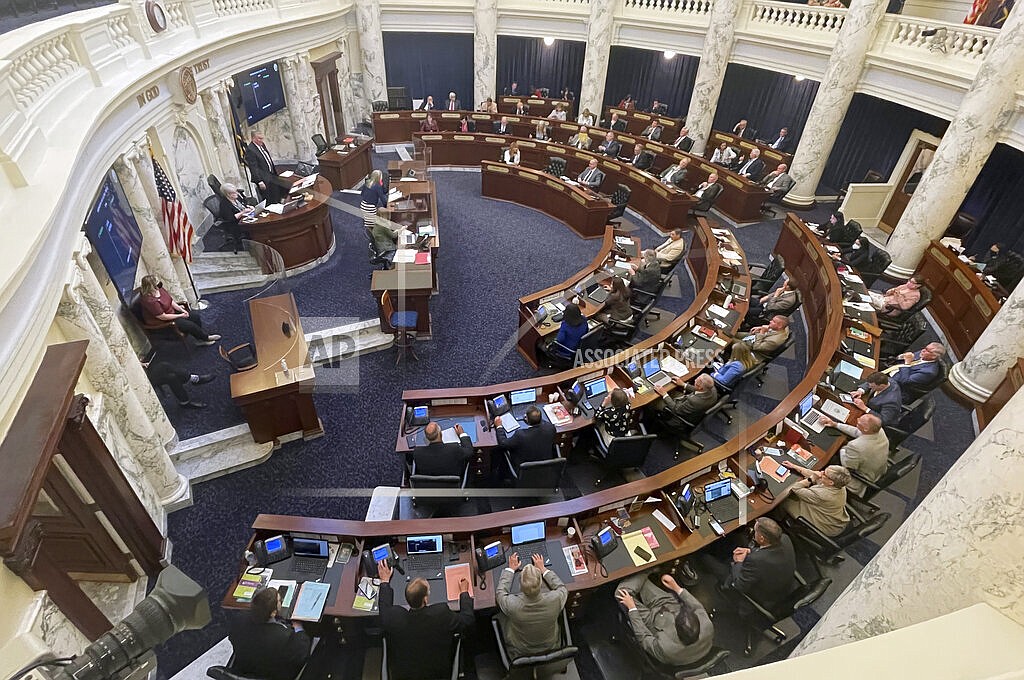

Record $600M Idaho tax cut heads to full Senate

By KEITH RIDLER

Associated Press

BOISE — Legislation containing Idaho’s largest-ever tax cut continued its apparent unstoppable trip through the Legislature on Thursday.

The measure cleared a Senate panel with no Democratic support and headed to the full Senate where Republicans hold a super-majority of seats.

The measure has already cleared the House, and Republican Gov. Brad Little has twice sent his budget chief to testify on its behalf, indicating his support.

The record $600 million cut includes a one-time $350 million in rebates and $250 million in permanent income tax reductions going forward for people and businesses.

Backers said the tax cuts return money to the people who paid it. Opponents said the tax cuts mostly benefit the wealthy at the expense of essential government services such as education.

Little's budget chief, Idaho Division of Financial Management Administrator Alex Adams, said the state over the last year had a 23% revenue growth, compared to 5.7% revenue growth annualized over the last 10 years. That's part of the reason Idaho has a projected $1.9 billion surplus.

“So Idaho is in a position to do some things that the state has never gone before,” Adams said, framing the argument as an overall function of good governance.

He said Little's budget includes a record $300 million education spending increase, plus spending $200 million ongoing for roads and bridges, the largest ever increase for transportation.

He also said the governor's budget paid off debt, put the state on a path to pay off deferred maintenance and increases the state's rainy day fund to the maximum allowed under state law.

He also said Little's ongoing budget spending growth is 8.1% despite the 23% revenue growth this year.

“He played it conservatively," Adams said. "We ensured that this budget balances over the next five years doing various economic inputs and stress tests.”

Democratic Sen. Mark Nye said he'd like to see the measure at least delayed, citing concerns that approving the bill would immediately remove $600 million that lawmakers later might want to spend someplace else.

“I'd like to see it deferred at least until we look at the other needs," he said. "In an ideal world, it would be nice to put this off for a little while until later in the session.”

Budget bills involving the big education and transportation increases are weeks away from being voted on in the House or Senate, and the education budget will likely face opposition from far-right-wing lawmakers.

Republican Sen. Regina Bayer said the income tax cut bill “has been perceived as a tax bill for the wealthy.” But she said there are other bills in the works, including one that increases a tax refund for sales taxes on groceries and another that increases a property tax exemption she said could help keep seniors in their homes.

“If we can advance all of those things together, we will have achieved something,” she said.