County to retain penalties, interest from delinquent property taxes

COEUR d’ALENE — Some city leaders in Kootenai County say the county is converting tax revenue belonging to their cities for the county’s use and that the move will cost local taxing districts thousands of dollars.

Meanwhile, the county asserts that the change is based on a section of Idaho Code that went previously unexamined.

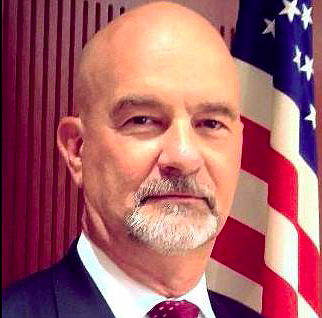

Kootenai County Treasurer Steve Matheson announced in a July 29 email to the taxing districts that the county will retain penalties and interest associated with delinquent property taxes to cover expenses incurred in collections.

The county previously distributed a proportional share of penalties and interest to the taxing districts.

Idaho Code provides that the county can collect “costs, late charges and interest” whenever a delinquency exists.

Costs include certified mailings, title searches, advertising and all other expenses for the processing and collection of the delinquency.

In an Aug. 4 email, Coeur d’Alene City Attorney Randy Adams said he believes the interest belongs to the taxing districts, not the county. Coeur d'Alene's anticipated share of penalties and interest would account for about $70,000 of its proposed $123 million budget.

Adams also acknowledged that Idaho’s property tax statutes are “pretty vague” about what should be remitted to taxing districts.

Matheson pointed to the Idaho Public Depository Law, which provides that the county treasurer “shall deposit, and at all times keep on deposit … all public moneys coming into his hands.”

Idaho Code defines “public moneys” as “all moneys coming into the hands of any treasurer of a depositing unit” and specifically includes all moneys coming into the hands of a county tax collector.

The section also provides that the treasurer is authorized and empowered to invest “surplus or idle funds” into certain investments permitted by Idaho Code. Interest received on such investments shall be paid into the general fund of the depositing unit — in this case, the county.

Because moneys received by the treasurer remain in the possession and control of the treasurer until they are distributed to other entities, Matheson said he believes the penalties and interest “fit neatly” within the definition of “idle funds.”

Post Falls Mayor Ron Jacobson objected to Matheson’s decision.

“Any interest and late fees on taxes that are owing should go to the taxing districts,” he said Wednesday. “Those are dollars that we have received every year. They are built into our budget calculations.”

He said the change’s annual impact on the city of Post Falls would be about $100,000.

Jacobson said the city of Post Falls’ attorneys disagree with the county’s interpretation of Idaho law.

“The statutes (Matheson) cited are not relevant and do not authorize the treasurer to keep those funds,” he said.

He said the cities of Post Falls, Coeur d’Alene, Rathdrum, Dalton Gardens and Spirit Lake are drafting a joint letter to commissioners requesting that the county not withhold the revenues.

“I would be surprised if any of the taxing districts concur with (the county’s) position,” Jacobson said.

Matheson said he considered the change for years and sought advice from the county’s legal counsel before implementing it.

He also said he anticipated pushback, though the overall budgetary impact will likely be small for most taxing districts.

“I expect that taxing districts are going to want clarification, either judicially or legislatively,” he said. “I am prepared and eager to receive that guidance.”

Though he informed commissioners of his decision before he announced it to the taxing districts, Matheson said the choice was his alone and within his authority to make.

“It was not their decision,” he said.

Jacobson said Matheson should have consulted the taxing districts before making such a drastic change.

Matheson rejected that suggestion.

“It’s not a negotiation,” he said. “To me, that seems misguided. I’m going to follow the law the best I can.”

Right now, Matheson said, the law is somewhat ambiguous. That can be addressed at the legislative or judicial level.

“I think the Legislature needs to do the job and clarify so we know where the money is supposed to go,” Matheson said. “I’m not sending out public dollars until I’ve got clear statutory or judicial guidance.”