CDA schools: Biggest levy but low tax rate

The Coeur d'Alene School District's $20 million two-year supplemental levy is the highest of any school district in Idaho.

It provides 25% of the district's budget and fills the gap left by the state, which funds the other 75%. The $20 million pays for things like school resource officers and campus safety officers, school nurses and mental health professionals.

Supporters of the levies say it helps recruit and keep quality teachers and other employees, as it is an important component of the district's salary schedule.

"It supplies our teachers so they don't have to dip into their own pockets to supply their classrooms," Coeur d'Alene School District communications director Scott Maben said Tuesday.

Levy funds pay for staff training, music and art classes, sports, extracurricular activities and new school buses.

They fund technology and tech support, which have become important as COVID-19 has brought on an era when remote learning is a necessity, Maben said.

"We hesitate to refer to it as our 'supplemental levy,'" he said. "We call it our local levy because it's become a fundamental part of our funding."

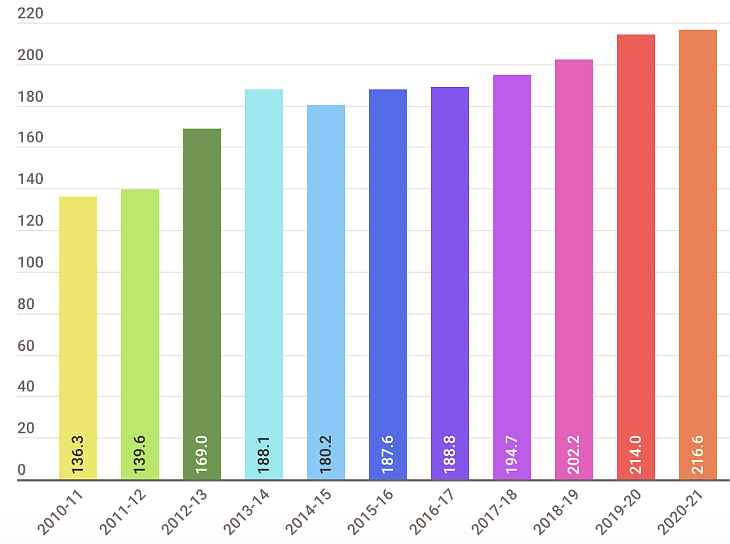

Idaho's supplemental levies have been trending upward by more than $80 million in the past decade. According to an article from Idaho Education News, Idaho school districts will collect $216.6 million in supplemental property tax levies this year, marking the fifth successive year of record supplemental levies across Idaho.

Looking at the supplemental levies across the state, Coeur d'Alene's is the highest. It covers a quarter of the budget in Idaho's sixth-largest school district, which has one of the lowest tax rates in the state at $1.79 per $1,000 taxable assessed value and falling. The supplemental levy is the only taxing mechanism used by the Coeur d'Alene School District, as well as construction bonds.

"In Idaho, supplemental levies are not the only way school districts can collect property taxes," said Katie Ebner, director of finance for the Coeur d'Alene School District.

She explained that school districts mainly generate funds using a few types of levies, including supplemental, bond, plant facility, emergency and budget stabilization.

Focusing on just the supplemental levy ignores that some districts choose one or more of these other means of collecting property taxes to operate their school district, Ebner said.

"For the full picture, it's best to look at the overall taxes collected when comparing the impact to each community," she said. "When you compare total levied to enrollment, Coeur d'Alene Schools ranks No. 34 in property tax dollars collected per student this year."

Coeur d'Alene's tax rate was $1.96 per $1,000 taxable assessed value in 2019, when Post Falls School District's was $2.07 and Lakeland Joint School District's was $3.48. Moscow School District's topped the chart at $7.06.

Ebner crunched some numbers to put into perspective where Coeur d'Alene lands compared with other school districts when it comes to enrollment and dollars levied per student.

Coeur d'Alene's 2020-2021 enrollment of 10,044 students and total levy amount of $24,591,896 equals $2,448 per student, including the supplemental levy plus bonds that were approved in 2017 and 2012. In Blaine County, No. 1 on the list, levy funding of $32,071,639 for enrollment of 3,156 equals $10,162 per student. In the larger Boise Independent School District, a total levy amount of $123,784,955 equals $5,189 per student.

Coeur d'Alene is proposing a two-year renewal of its supplemental levy with no change in the amount for the March 9 ballot.

In other Coeur d'Alene School District news, Superintendent Steve Cook is still in the running as a finalist for the Bend-La Pine School District in Oregon. An announcement is expected to be made next week.