Trump, Congress near deal on small business, hospital aid

WASHINGTON (AP) — The Trump administration and Congress are trudging toward an agreement on an aid package of more than $450 billion to boost a small-business loan program that has run out of money and add funds for hospitals and COVID-19 testing.

The package is nearly double the $250 billion that President Donald Trump requested almost two weeks ago. Trump was nevertheless among those offering optimistic assessments on Sunday, telling the public “we are very close to a deal” during a White House briefing.

But the timeline for a deal wasn't immediately clear. The Senate is scheduled for a pro forma session Monday afternoon that could have provided a window to act on the upcoming measure under fast-track procedures requiring unanimous consent to advance legislation. But it's has become clear there won't be a deal in time to pass it by then.

One option is to set another Senate session for Tuesday if an agreement appears likely to be sealed and written up by then.

The House announced it could meet as soon as Wednesday for a vote on the pending package, according to a schedule update from Majority Leader Steny Hoyer, D-Md. The chamber is likely to have to call lawmakers back to Washington for a vote, which will present logistical challenges.

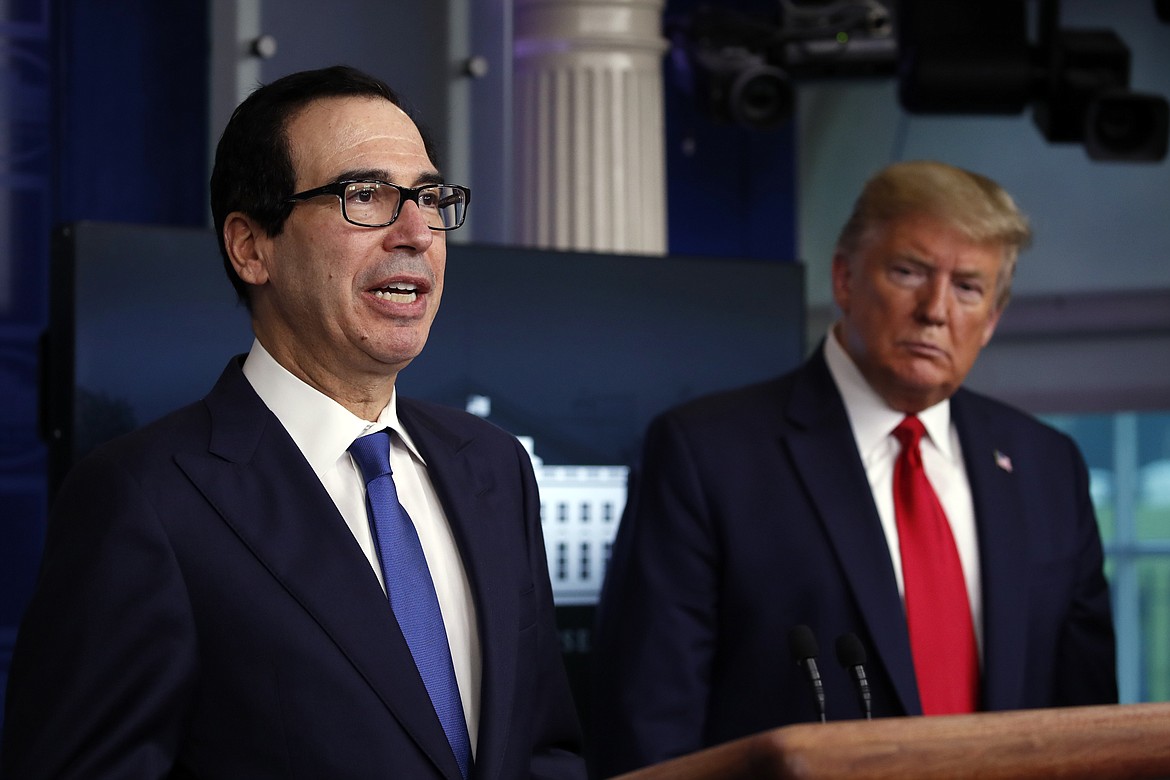

With small-business owners reeling during a coronavirus outbreak that has shuttered much economic activity, Treasury Secretary Steven Mnuchin — the administration's point man in the talks with Democrats — said he was hopeful of a deal that could pass Congress quickly and get the Small Business Administration program back up by midweek. But optimism of an immediate deal was being tempered.

“I heard today from our legislative affairs team that they are hopeful we can get a deal this week,” top White House adviser Kellyanne Conway said Monday on Fox News. “The secretary feels very confident. He said that yesterday that a deal is happening. Much better position than we were, say, a week ago."

The emerging accord links the administration’s effort to replenish a small-business with Democrats’ demands for more money for hospitals and virus testing. It would provide $300 billion for small-business payroll program, and $50 billion would be available for small business disaster fund. Additionally, it would bring $75 billion for hospitals and $25 billion for testing, according to those involved in the talks.

On a conference call Sunday afternoon that included Trump, Mnuchin and Republican senators, Senate Majority Leader Mitch McConnell, R-Ky., indicated the only remaining item for discussion involved the money for testing, according to a Senate GOP leadership aide who spoke on condition of anonymity to discuss a private call.

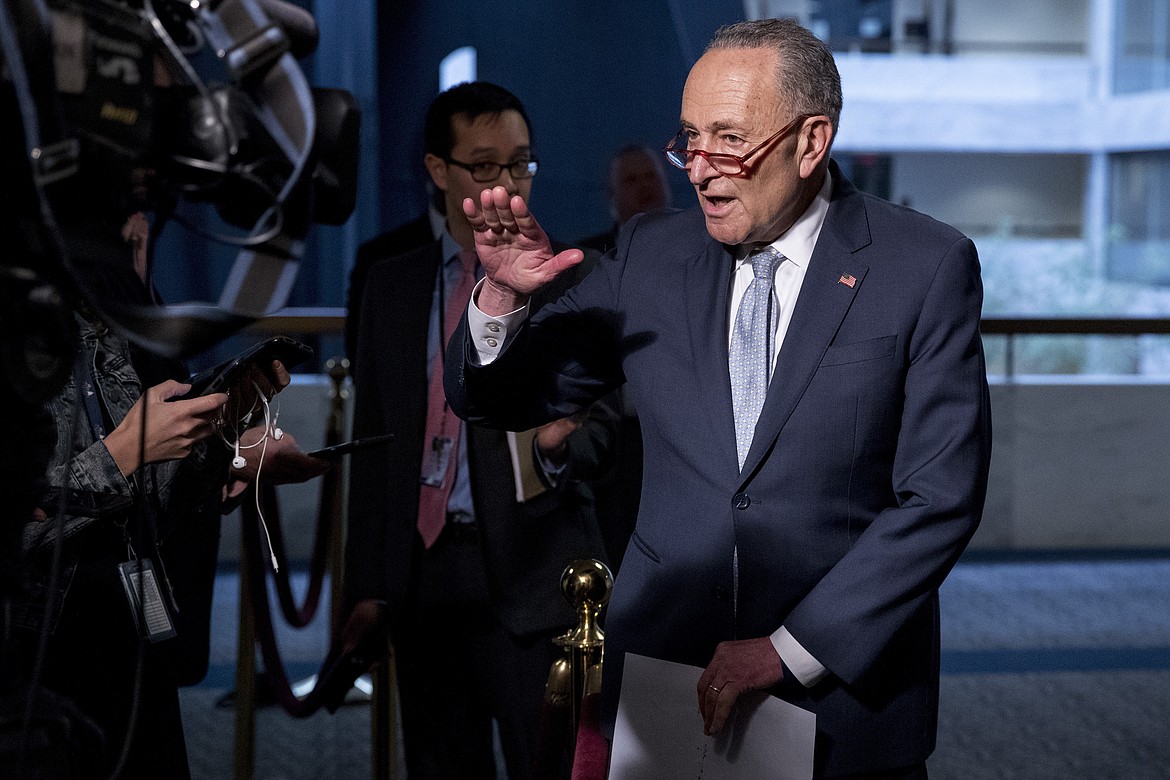

Democrats have been pushing to boost funding to cash-strapped states and local governments whose revenues have cratered. They had proposed $150 billion for the effort but GOP leaders stood hard in opposition, at least regarding the current package of COVID-19 aid.

“The president is willing to consider that in the next bill, but wants to get this over the finish line with a focus on small businesses, hospitals and testing,” Mnuchin said Sunday on CNN.

The government’s Paycheck Protection Program for small businesses, slated to get more than $300 billion under the emerging deal. The program has been swamped by companies applying for loans and reached its appropriations limit last Thursday after approving nearly 1.7 million loans. That left thousands of small businesses in limbo as they sought help. An additional $50 billion in the evolving deal would go for disaster loans.

About $75 billion would go to U.S. hospitals, for those straining under a ballooning coronavirus caseload as well as those struggling to stay financially afloat after suspending elective surgeries during the pandemic. About $25 billion would be added for COVID-19 testing, something states have said was urgently needed.

The SBA loans, based on a company’s payroll costs, offer owners forgiveness if they retain workers or rehire those who have been laid off. The law provides for forgiveness for companies in any industry — even businesses like hedge funds and law firms. There’s a limit of $100,000 on the amount of employees’ compensation that can be considered when loan forgiveness is calculated.