Tax anxiety?

By HOLLY PASZCZYNSKA

Staff Writer

Warren Fisher can remember a time, about 20 years ago, posted up in the concourse of the Silver Lake Mall just outside the long-gone Granny’s Buffet, pencil in hand and carbon paper at the ready, he helped file tax returns for members of AARP. That year about 15 returns were processed. Fast forward to today, with the changes in technology and in the Tax-Aide program, and about 4,000 returns are expected to be handled at the Silver Lake Mall site alone. He explained that between all six of the area’s Tax-Aide assistance sites, 6,000 returns are expected, which accounts for about 10 percent of all returns for Kootenai County.

AARP Foundation Tax-Aide is a free service aimed at assisting low- to moderate-income persons file their returns electronically by IRS-certified volunteers in more than 5,000 locations around the nation. You don’t need to be an AARP member, or over the age of 50, to take advantage of this program.

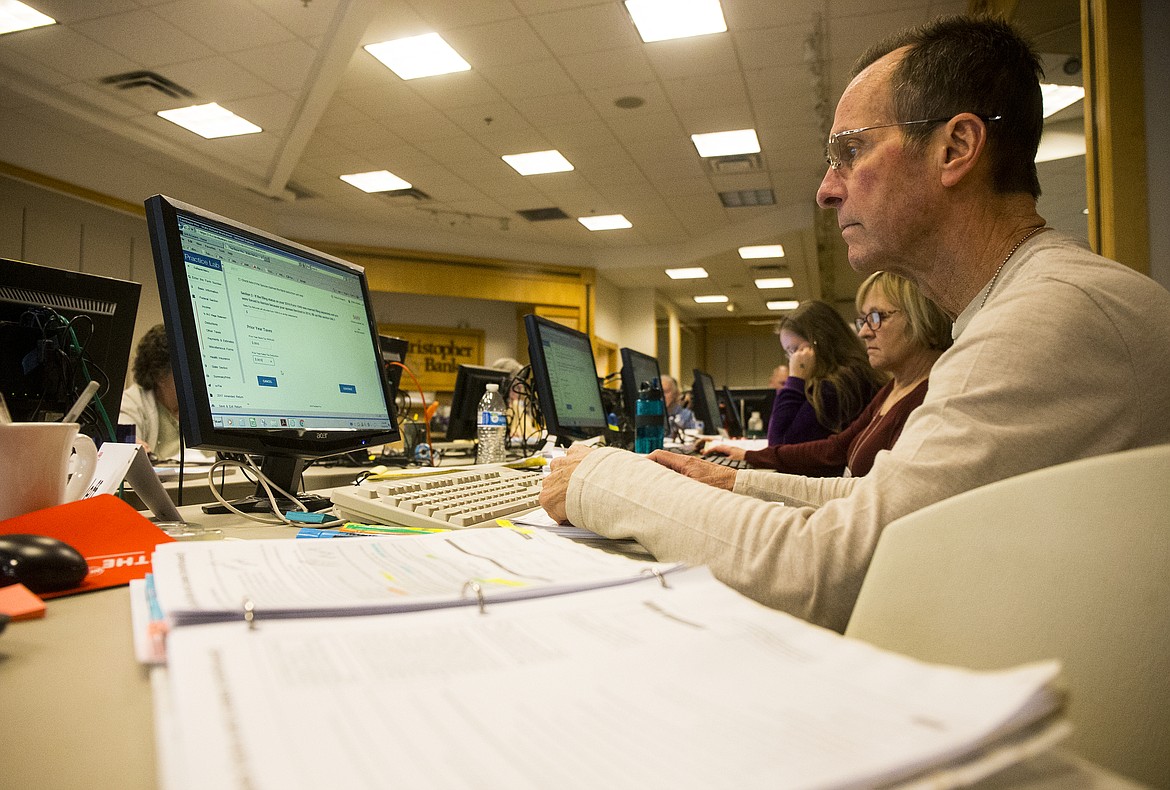

In North Idaho, around 100 volunteers are learning the program, honing their past skills and getting certified to assist at six different locations beginning on Feb. 1. Volunteers must take 30 to 40 hours of classroom instruction and computer-based training, pass an IRS certification examination and successfully complete a number of sample returns before they are able to start the real work. This year Fisher estimates about half of the volunteers are returning participants, with a handful of people such as himself that have done this for around 20 years.

One thing that keeps volunteers coming back is a sense of camaraderie and friendships that are forged, and the gift of helping members of the community. Michele Brechlin moved to North Idaho about a year and a half ago, and she decided to volunteer with the program after an instance where she was visiting the mall and saw a large crowd of people waiting for assistance at the first come, first-served location. “I was very curious, so I just kind of peeked in and read the signs and I was like, ‘Oh my gosh, what a great service!’ When we moved here I was looking for a way to both give back and get connected, and I’m already a full-charge bookkeeper, so I thought, ‘OK, I can use my skills and expand them.’ It’s been an awesome experience. Everyone is having a good time and picking everything up.”

Karen Cumings has been a Tax-Aide volunteer for the past three years, and she explained that while there are volunteers of all different ages and backgrounds, many are elderly and want to keep their minds fresh while helping others. She had left her career to spend more time with her kids, and when they got older she felt she should go back to work but wasn’t sure what she wanted to do. “When I read about the program in the newspaper, I was like, ‘You know what? Until I can figure it out, let me go and get involved in this.’ And I’m still here.”

She also appreciates the fun she has had and friendships made through the program. “It’s a great organization. It’s so driven by the people that run it, because a lot of us wouldn’t be here if it wasn’t such a positive social experience. It’s hard to explain.”

“Most of our volunteers are not CPAs or trained in taxes,” Fisher said. “Most are retired and most of us are just people who want to give back to the community, but we do have a handful of college students from both NIC and Lewis and Clark that are studying accounting or bookkeeping. They are interns with us and they actually get credit for taking our class and working with us.”

One thing to note is the Tax-Aide program does not take responsibility for returns, they are simply there to assist and walk people through the process. Individuals are still signing their returns, and responsible for providing accurate information and necessary paperwork and verifications.

More complicated returns may be referred back to a certified professional, but Fisher went on to explain that even some small businesses can utilize the service. “We could end up helping a person that has a tutor business or a person that does nails. We do the paper delivery people. We have a lot of people that have small businesses who can come to us and the limitations that we have do not affect them. So yes, small business is something we do.” Limitations would include a business that has employees, inventory, or depreciation of any kind.

Those looking to receive help this tax season can take advantage of this program, running from Feb. 1 through April 14, by calling to make an appointment at one of the five appointment-only centers, or by visiting the Silver Lake Mall walk-in center.