Post Falls leaders suggest path forward on property taxes

This is the second of a two-part series.

POST FALLS — City Administrator Shelly Enderud has devoted many hours to analyzing the community's tax structure and impacts.

Her research has led her to conclude that the Legislature's recently passed House Bill 389 will likely result in both harmful and long-term effects.

But instead of simply criticizing, Enderud, her staff and city leaders have come up with suggestions to help taxpayers while ensuring essential services for residents can continue.

HB 389 aims to slow rising property taxes by placing budgetary caps on local governments. Restrictions include the allowed collection of:

• 90% new growth dollars, a cut of 10%

• 80% Urban Renewal District revenue, a cut of 20%

• 8% total budgetary growth per year — including a 3% property increase, new development, and Urban Renewal District revenue

The caps, Enderud said, stem from lawmakers' concern that residents are being taxed unreasonably to meet growth demands. Local legislators generally feel that Post Falls "does a great job," Enderud said, but that other areas don't.

"They needed legislation that keeps those other taxing districts in check," she told The Press. "If there's true abuse, then that should be addressed and taken care of. But they shouldn't take away the legal authority to use those incentives for taxing entities."

The Post Falls tax rate per $1,000 has declined since 2016, from 5.594 to 3.909 in 2020, Enderud said. She attributes the decrease to council decisions to not increase property taxes by the 3% annually allowed by state law.

"The council has been able not to take that because they've had those new growth dollars," she explained. "The budget has increased, but it's only to the amount that those new growth dollars allowed."

Still, Enderud said, the shifting tax burden and rising market values continue to raise tax bills.

Using Multiple Listing Service data, Enderud calculated how the property tax bill of a median-valued Post Falls home grew between 2016 and 2020. To figure that change, Enderud used this formula:

•Taxable value (home value — the homeowners exemption) x Tax Rate = Taxes Due

The 2016 data, with a median home valued at $244,623:

•$154,812 x 5.594 = $865.99.

The 2020 data, with a median home valued at $409,820:

•$309,820 x 3.909 = $1,210.99.

"The home saw a 100% increase in value, but only a 40% increase in taxes," Enderud said. "The increase in taxes is coming from that tax shift from other entities that aren't increasing at that same rate.

"So they're paying a little bit of the taxes for their grocery store or the convenience store, whereas all those other commercial and industrial users are paying less," she said.

A means to stabilize property taxes is limiting the taxable market value percentage that can increase from year to year, Enderud said. That concept is applied in other states, like California's Proposition 13.

Prop 13 limits a homeowner's property tax rate to 1% of the initial market value and caps annual assessment increases at 2%. Therefore, the longer owners stay in one home, the lower their tax rate will be despite a rising market value. When a change in ownership occurs, the property is reassessed to market value on the date of transfer.

Sen. Mary Souza, R-Coeur d'Alene, said she has heard of ideas like Prop 13, but nothing has been brought through the statehouse.

"We have to see the whole picture before we can make any decision," she said, "like what the unintended consequences could be and who would be picking up the tab for what is not being paid."

Coeur d'Alene Rep. Jim Addis said he doesn't see an initiative like Prop 13 happening in Idaho. He said it would require Idaho to become a "disclosure state" on real estate transaction prices.

"I think there is a strong sentiment in Idaho voters and the real estate industry not to do that," Addis said.

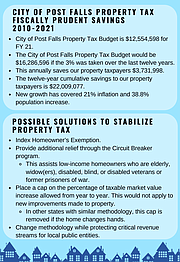

Other solutions recommended by Post Falls staff include:

• Providing more relief through the circuit breaker program

• Reintroducing the index homeowners exemption

Addis, a member of the interim property tax commission, said lawmakers are considering more options to help local taxpayers. Still, he said, he is hesitant to push statewide programs when local spending is the issue.

"It is too soon to tell what is going to happen next year," he told The Press. "At the legislative level, my priority is to give perfect transparency so people can decide what they want to spend money on locally, and the state doesn't have to step in. I think that is the true solution to property taxes."

Both lawmakers noted a significant influence on property taxes in local government spending.

"The bottom line for any of this taxation is the budget for all the taxing districts. That is where the tax rate is determined. If the budgets stay lower, then the tax rate for commercial and residential will stay lower," Souza said.

"It's a spending issue — not saying there is anything wrong with that, and it is a local taxing district's decision on whether or not to increase their budget," Addis said. "That is why the local folks have to decide what they want to pay for in government.

"The local taxing entity is free to spend less. No one is putting a gun to anyone's head."