Personal financial stress can crack workplaces

By BRIAN WALKER

Staff Writer

POST FALLS — The 39 percent of the total households in Kootenai County either living in poverty or below the basic cost of living is having ripple effects of stressed-out employees and it will take an army to address the issue.

That theme rang throughout the Idaho Department of Labor's "Financial and Mental Wellness in the Workforce" workshop Thursday.

"Those populations are growing sometimes faster than the community as a whole is growing," said Craig Sumey, senior pastor at First Presbyterian Church in Coeur d'Alene and a workshop speaker. "People are dealing with stress all of the time and it's eroding their soul and the fabric of our community.

"We think this is a crisis in our community. When businesses have stressed-out workers, that affects our product."

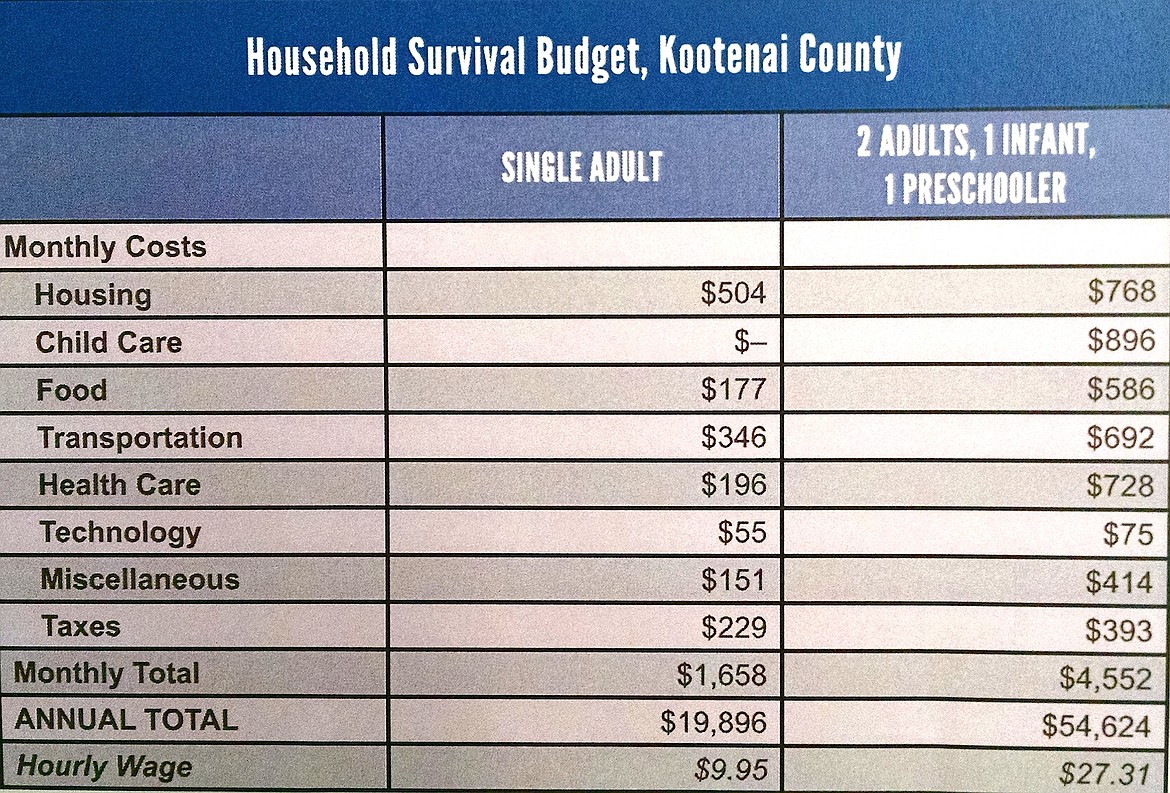

According to a report released by United Way of North Idaho, which cites Census data from 2016, 16 percent of the households in Kootenai County were living under the federal poverty level of $11,880 per year for a single adult and $24,300 for a family of four.

An additional 23 percent of the households were under the basic cost of living of $19,896 ($9.95 per hour) for a single adult and $56,624 ($27.31 per hour) for a family of four.

Forty-eight percent of the households in Coeur d'Alene were under one of the two categories, while 41 percent were in Post Falls; 33 percent, Hayden; 46 percent, Rathdrum; and 63 percent, Worley.

Barb Smalley, St. Vincent de Paul of North Idaho's development director who attended the workshop, called the numbers "huge."

Keri Stark, United Way's community impact director, offered attendees an interactive financial exercise to illustrate just how difficult it can be if you're down to your last $1,000. Unexpected turns — or even everyday life — quickly put a crimp on finances despite sacrifices that were made along the way.

In that exercise, attendees made it through the month at the end of the exercise with $29 — but they also learned that rent was due the next day.

Stacey Hanlon of the Labor Department said the topic hits close to home from her days as a single mom suffering from anxiety.

"It's important for me to understand the lives of employees or co-workers," she said.

Sumey said there's a stigma that comes with receiving help, which in turn can also make it difficult to assist those in need.

"It's hard to do, particularly when they think they're doing the right thing (by working hard)," Sumey said. "People often feel like they're giving away their power if they have to reach out for support."

New efforts presented at the worksop to help those in need include a local ALICE (asset limited, income constrained, employed) task force formed to tackle the issues of education, health care and transportation, and a network of banks called Bank On that offers free seminars on money management.

Shannon Corder, a clinical social worker with Kootenai Behavioral Health, encouraged attendees to look for the signs of stress, anxiety and depression among their co-workers.

Chronic fatigue, forgetfulness, loss of appetite, anger outbursts, diminished physical appearance and taking time off frequently are among the signs.

"Get to know your employees so you can understand what they are going through," she said. "Lift them up. A lot of people can hide it well."

Corder said some employers such as hers offer financial and mental health counseling, nutrition coaches and affordable gym memberships to boost employee well-being and productivity.

Mark Tucker, United Way's executive director, encouraged attendees to not look at the financial and mental health situation as an "us and them" ordeal; the goal, he said, is financial stability for all.

"This is a community issue that's going to take collaboration and sharing of resources," he said. "The recession is not clearly over here as it is in a lot of places and, with housing prices going up significantly, it makes it even harder."