An appealing market

By BRIAN WALKER

Staff Writer

COEUR d'ALENE — Kootenai County's Assessor's Office was bracing for a flood of property assessment appeals since this was the year for waterfront evaluations.

But that storm — typical tempests when such properties are re-assessed on a five-year schedule — blew over.

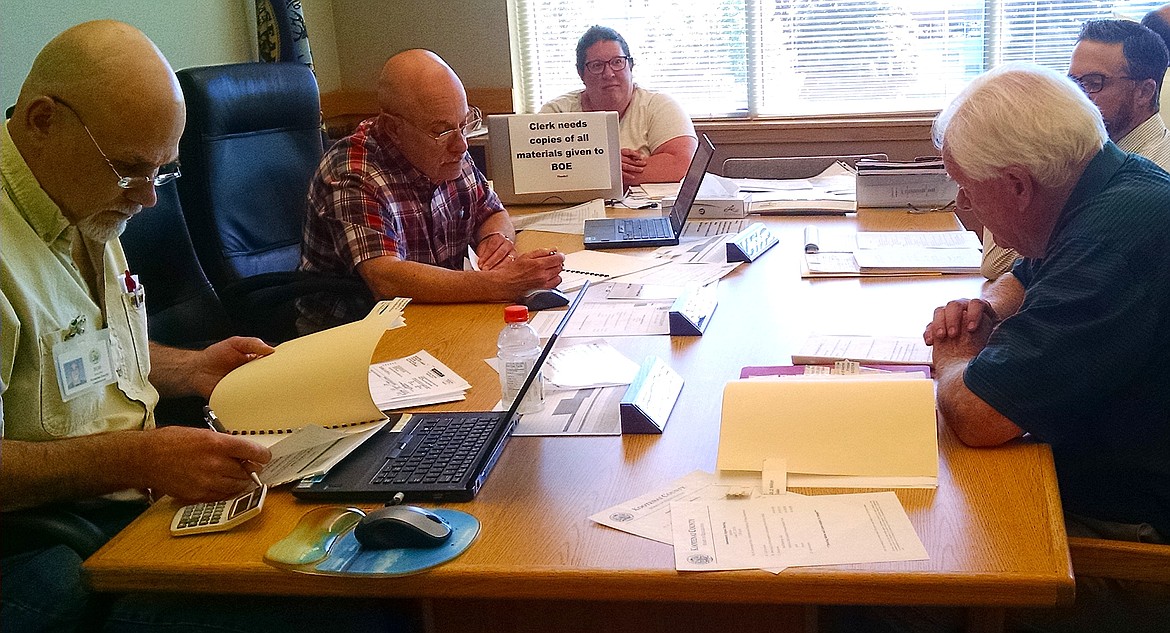

County commissioners, acting as the Board of Equalization, started on Wednesday their two-week run of hearing a total of 47 assessment appeals covering 71 parcels.

The number is down from 87 parcels in 2017 and 91 in 2016. It represents less than 1 percent of the total 92,500 assessment notices the county mailed out in May.

"Waterfront years usually produce more counter activity (of questions or concerns), but we did not see that this year," said Rich Houser, the county's chief deputy assessor. "I would venture to say that most people realize that we are in an escalating market and that our assessments typically are low compared to what property is currently selling at.

"Another factor is that our assessment data is available online so people can make comparisons."

In 2006, at the peak of the market, there were more than 1,200 parcel assessment appeals. The line of property owners extended outside the Administration Building.

Houser said this year there were 316 reviews between property owners and county staff, resulting in conversations that satisfied the residents and whittled down the number of hearings.

While the number of hearings is down, testy moments still exist.

Don MacDonald, who lives in Hayden Lake's West Coast neighborhood, had his property and home assessed at $1.97 million. Based on his analysis of sales of comparable properties and other data, he argued that it should have come in at $1.38 million.

He called the assessment "outrageous and unfair." MacDonald, who also lost appeals last year at both the BOE and State Board of Tax Appeals levels, said the number the county arrived at was "arbitrary" and cited assessment laws he believed were broken.

At one point, Craig Sullivan, a property owner who attended the hearing with MacDonald, attempted to speak in his favor, but was quickly squelched when board member Chris Fillios, a real estate agent, reminded him that the hearing was between the appellant and the Assessor's Office only.

Appraiser Ryan Rouse said MacDonald's testimony of how the county arrived at the assessed value was incorrect.

BOE members Fillios and Bob Bingham ruled that the stated assessed value should stand. Board member Marc Eberlein wasn't present. He’s reportedly attending the Republican convention in Pocatello.

In another case, Wall Holdings, LLC filed a written appeal, arguing its land near Prairie Falls Golf Course in Post Falls was assessed at $70,000 and argued it should have been $56,000. The appellant argued that the percentage of increase shouldn't have been as high as it was, as the average hike of other properties was a smaller number. However, the BOE upheld the county's assessed value in that case as well.

"I'm in the same boat (with a large increase), but this is becoming a popular area to move to," Bingham said. "It's just the market. People are willing to pay more to get into this area."

Fillios added: "In the past three years, values in some areas have almost doubled, especially in the northern part of the county. The greatest appreciation is occurring in the land values. It's the land that's becoming more and more valuable."

Assessment notices that went out in May are based on 2017 sales data. The board can't adjust value based on the amount of taxes due or the owner's ability to pay the amount on a property tax statement.

Houser, who has been involved in appeals for about 30 years, estimates that about 90 percent of the time, the BOE upholds the value.

"State law states that the Assessor's Office is assumed to be correct unless it's proven to be incorrect by the property owner," he said.