SBA: The business friend you haven't met yet

In a sea of acronyms, SBA might be one of the least understood — and one of the most undervalued.

SBA stands for Small Business Administration, and its impact on small business is huge.

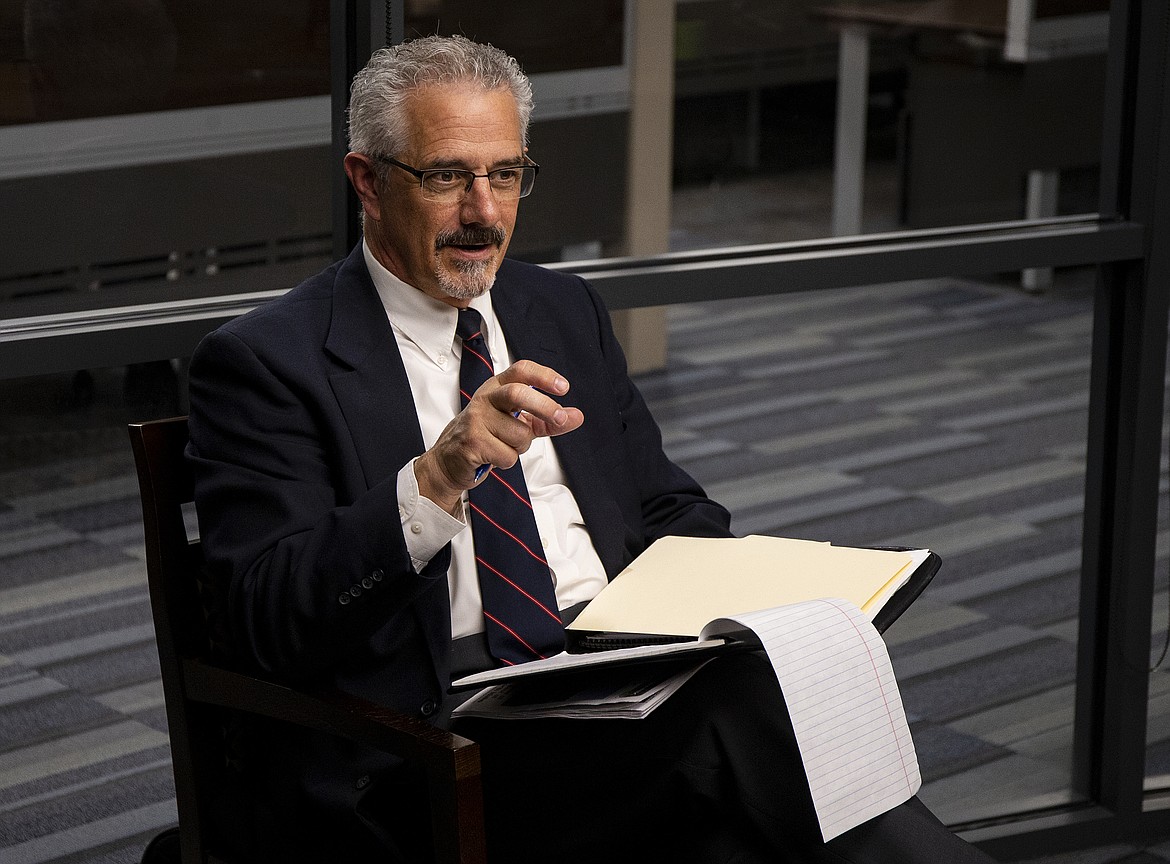

A trio of SBA officials recently visited Coeur d’Alene, with their primary target being Steve Wilson, head of the Coeur d’Alene Chamber of Commerce. The SBA ambassadors are working with Wilson to bolster partnerships for the benefit of local businesses. They made time for the half-block trek to North Idaho Business Journal HQ.

The visitors included Kerrie T. Hurd, an Idaho girl who serves as the Seattle-based SBA district director. Jeremy Field, Seattle-based regional administrator, also has Idaho roots. Among other Gem State ties, Jeremy worked for Sen. Jim Risch for nine years. Rounding out the group was Joel Nania, the Spokane-based economic development specialist with a broad and deep understanding of and appreciation for North Idaho.

What follows is select portions of a Q&A that was not just illuminating, but invigorating. If you ever wonder how well your government is working for you, well, Hurt, Field and Nania might be Exhibit A in evidence that it’s working pretty darned well.

This is the first of a two-part Q&A. It’s been lightly edited for clarity.

- • •

NIBJ: Let’s start at the beginning. The Small Business Administration is one of the best toolboxes a new or existing business could use at little or no cost, but many people don’t know much about it beyond maybe SBA-guaranteed loans for small businesses. What is SBA?

JEREMY FIELD: It’s a catalyst to help small businesses. We’re here to help you with any part of a business life cycle. If you’re starting a business, if you’re growing your business, if there’s some sort of recovery involved, we can help.

People don’t understand that it’s a federal agency. Our administrator is part of the (president’s) administration. It’s this wonderful secret that shouldn’t be a secret.

NIBJ: Do tell.

JEREMY: If people just knew, ‘Man, I have this HR issue and I don’t know anything about it,’ they can talk to someone at the Small Business Development Center (at North Idaho College) for free and get expert advice on how to handle the issue. ‘I don’t know how to market online.’ We do that!

We teach people how to read financial statements. If you’re trying to figure out how to value your business because you’re ready to sell it, we’ll run you through your profit-loss statements and help you figure out what would be a fair price. There are so many services that are no cost.

NIBJ: Having questions about starting or improving your business doesn’t show weakness or worse, right?

JEREMY: Right. Nobody knows all of it. There are too many hats to wear in a small business. The SBA is a resource to help you fill in those gaps.

NIBJ: So here’s this big agency with a budget of about $800 million and its administrator, Linda McMahon, is probably better known for professional wrestling than professional business development. How kind — or not — has the Trump Administration been so far to SBA?

KERRIE T. HURD: Over 50 percent of the jobs are from small businesses, so for the government to say this is important to us, I think that’s a big statement that’s been made and the American Dream has been supported. We’re actually a small agency with a big impact. We’re one of very few agencies that isn’t taking any staff reductions. However, that doesn’t mean we aren’t innovating and trying to do things more efficiently.

NIBJ: “Federal” and “agency” might not be warm welcoming words to some North Idaho entrepreneurs and small business owners. How do you overcome that kind of anti-federalism when trying to help people start new businesses or grow existing ones around here?

KERRIE: We are a federal agency with the power of the government behind us, which is pretty good leverage to bring resources. At the same time, our programs are for the most part delivered by our community partners.

If people have heard of SBA loans, it’s mostly the bank they already bank with that’s going to lend them the money. We’re behind the scenes more like an insurance company, guaranteeing that loan.

If they need consulting or counseling services, we can bring our partners, like Bill Jhung of the Small Business Development Center, to their attention. Even if someone is anti-government, they might want to sell their products or services to the government. We can help them…be able to compete for those contracts.

JEREMY: The American tradition is not trusting government. So go ahead and applaud your audience for their American spirit. The frustration comes when government is perceived to get in the way of someone achieving something, and we are literally a catalyst to help them achieve the American dream.

If there’s a regulation they don’t like and the government’s in their way, we’re going to advocate for them with the SBA advocates. We want the specifics and we’ll advocate to get that regulation pulled back. We’re a different agency.

JOEL: One of the things that was clear when we tlaked to Steve (Wilson at the Cd’A Chamber) was that of all the federal agencies, the SBA is extremely bipartisan. Both parties want to encourage and enhance business. Nobody is against the small business or the entrepreneur being successful. Republican or Democrat? I can’t even ask. We’re going to help you.

- • •

NEXT MONTH: How you can SCORE and ways SBA can help North Idaho.