A bubble that won't pop

Kootenai County's housing trend has become a looming menace in the area, but Jennifer Smock of Windermere/Coeur d'Alene Realty, Inc. believes that it is not a bubble waiting to pop.

Smock, co-owner and managing broker for Windermere/Coeur d'Alene Realty, Inc. in Post Falls, explained to attendees of the Post Falls Chamber of Commerce's "Coffee Connections" event Wednesday that the explosive interest in Kootenai County homes will not push the market over the edge.

When COVID-19 hit, Smock said she was on the beach in Mexico, and frankly, she didn't want to leave. After the housing crash several years ago, she expected real estate agents to suffer. The opposite happened, and people moved in droves to Kootenai County.

Smock estimates 250,000 people live in the collective Kootenai, Shoshone, Bonner, Boundary, and Benewah counties. Kootenai County alone roughly contributes 166,000.

Comparatively, there are about 118,000 housing units.

"That is way, way, too low," Smock said. "In case any of you recently have tried to find a house, or buy a house, or worse yet found a house to rent, it is nearly impossible."

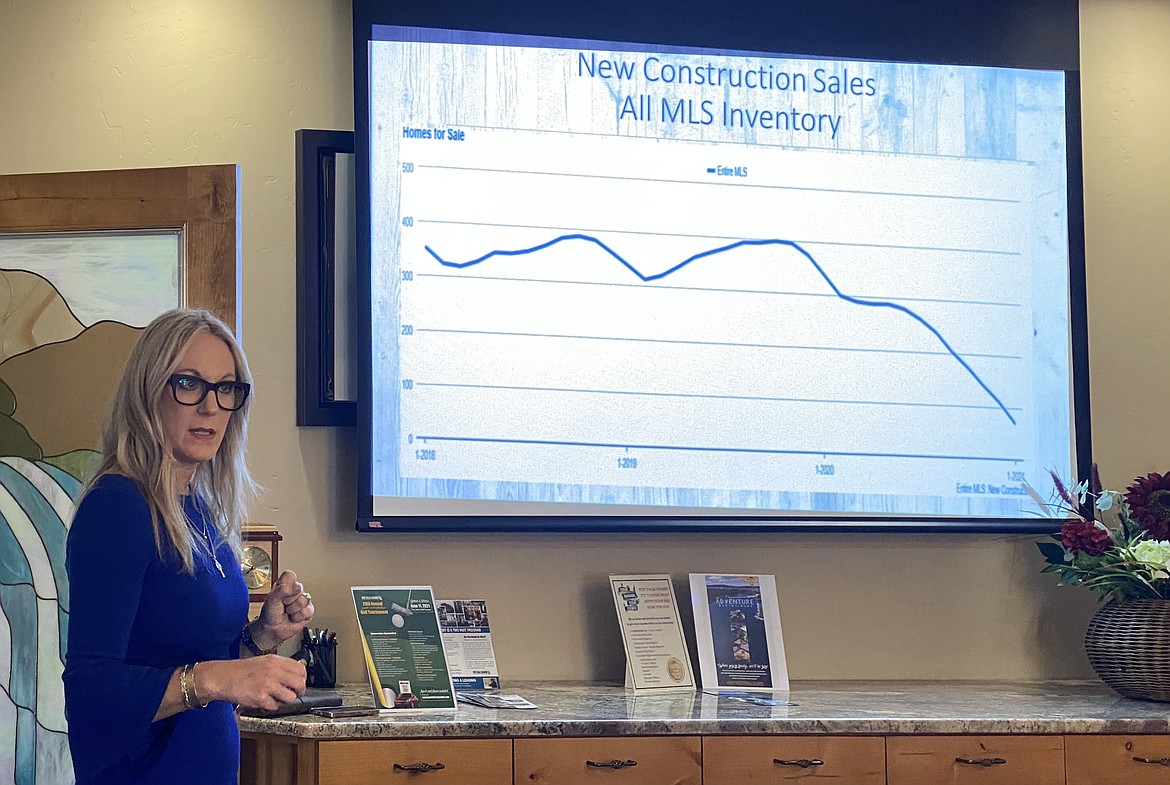

As of Wednesday morning, Smock said the Multiple Listing Service (MLS) — a database used by real estate brokers that provides market data — reported a total of 412 active listings in the North Idaho area, an inventory decrease of 79%.

"We should have about 1,500 right now," Smock said. "We're feeling super pumped because we have over 400 because we were way down. At our lowest point we were at like 205. There was one listing in Post Falls, one."

A trend Kootenai County residents are all too familiar with is the rate houses are selling. According to the MLS, the average days on the market is about 100. However, Smock said real estate agents with Windermere/Coeur d'Alene Realty, Inc. are experiencing closer to a 10-day turnaround.

Added to the quick sales pace, house prices are climbing. Referencing single-family home price differences from January 2020 to March 2021, the medium price of properties under two acres increased by 53% — from about $311,000 to $475,000. Single-family homes on more than two acres had a slightly higher bump, 56%, from $480,500 to $753,000.

To experienced real estate agents like Smock, the current housing market's lack of product and influx of demand in Kootenai County is insane. Part of the increase is due to incoming buyers dishing out cash, Smock said, and properties are selling for more than their original price, setting a new benchmark appraisal.

"There's a lot of money coming into this area. I don't just mean the $400,000 buyers. I'm talking about people paying cash for these million-plus homes," Smock said. "Typically, we have a 20% to 25% cash ratio here. Now it's more like 40% to 45%."

There is a reprieve on the horizon, albeit a long horizon, Smock said. The future of housing inventory is bright, she believes, as city and county planning departments slowly work through a backlog of building permits for residential housing with the aid of outside companies.

"We've got hundreds of acres sitting there waiting for a permit," Smock said. "We could have 400 homes on the market this year, just from our company alone, and we're not even a big production builder."

Another sign that this housing boom won't burst is a new trend of what Smock calls "pushback" from buyers who are refusing to purchase an overpriced property simply because the market is hot. As this becomes more common, Smock said lower prices would follow.

"We do see some price reductions," she said. "That's a good thing. The price reduction shows that consumers that got greedy couldn't make it work, and now they're 10 days on the market and coming down in price. Then people are making offers at a realistic price."

Other signs Smock believes the housing bubble won't pop are:

- Mortgage standards are more rigorous than they were during the last housing crisis,

- Prices aren't soaring out of control,

- There are not the surplus of homes that there were in the previous housing crisis,

- New construction isn't making up the difference, and it will take time before builders pick up the pace,

- Houses aren't becoming too expensive to buy,

- People are currently 'equity rich' following almost two years of historically low national interest rates

"This is not sustainable growth, absolutely not sustainable growth, but we are seeing pushback now. Thank goodness," Smock said. "We are educating our Realtors, having those crucial conversations every single day with their sellers. We need to be looking at the economy as a whole in our area."